The crypto market rebounds sharply, but what's next?

The crypto market rebounds sharply, but what's next?

Market Picture

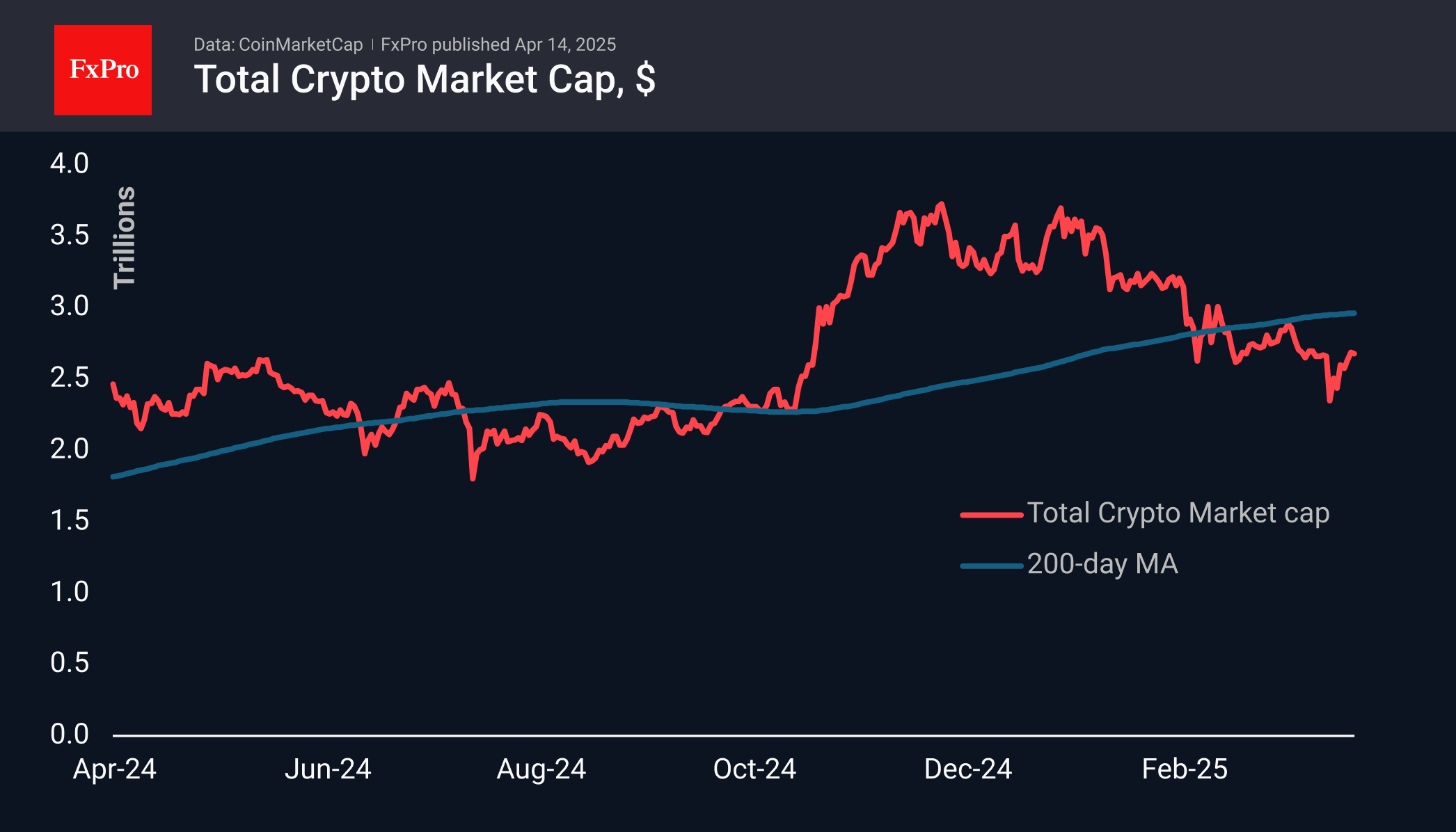

Crypto market capitalisation has risen by 13% over the past seven days, although there was no significant change over the weekend. This generally looks like a rebound after a drop. Only a rise above the local highs of $2.85 trillion will signal an upturn.

Market sentiment has moved out of the ‘extreme fear’ area into the ‘fear’ area, reaching 31. The index has been in the range of 18-45 for the last seven days, showing positive dynamics and supporting the improvement of market sentiment.

Bitcoin came close to the $85K level, making attempts to break through the 50-day moving average. A sustained consolidation above this level will be an important signal of a trend change. For long-term traders, overcoming the 200-day average, which is directed upwards and passes through $87,500, will be a more reliable reference point.

News Background

Net outflows from spot Bitcoin ETFs quadrupled last week to $713.3 million, continuing for the second week in a row, SoSoValue notes. Cumulative inflows since Bitcoin ETFs were approved in January 2024 fell to $35.36bn.

Outflows from spot Ethereum-ETFs in the US have now lasted for seven consecutive weeks, reaching $82.5 million in the past week. Since the ETF's launch in July, cumulative net inflows have fallen to $2.28bn.

At the end of the first quarter, BlackRock's total crypto assets under management were $50.3bn, equivalent to about 0.5% of its $11.6 trillion in total assets.

The New Hampshire House of Representatives has approved a bitcoin reserve bill. If the Senate and governor approve the document, up to 5% of the state's funds will be dedicated to precious metals and BTC investments. In North Carolina, lawmakers proposed using cryptocurrencies as a means of payment.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)