US PPI gives more encouraging signals, but markets may have a break

US PPI gives more encouraging signals, but markets may have a break

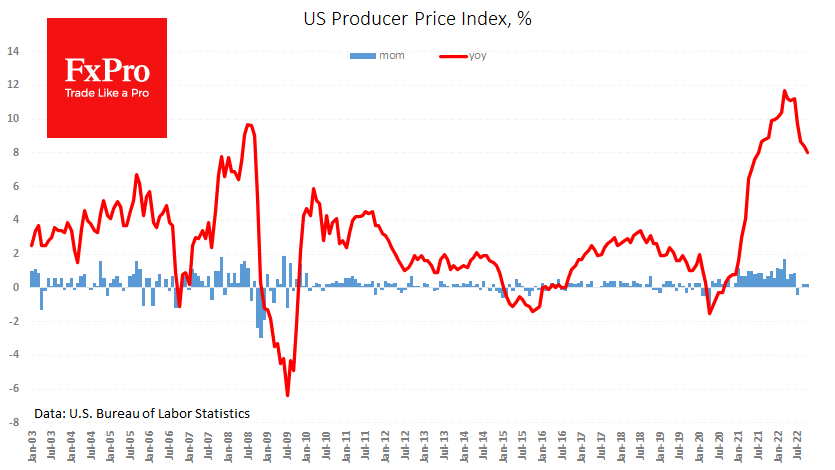

Inflation in the USA continues to slow faster than expected. In October, PPI showed a gain of 0.2% m/m and 8.0% y/y against expectations of 0.4% and 8.3%. Producer prices often leads consumer inflation trends. For example, CPI peaked in June, three months after the PPI.

The core producer price index slowed to 6.7% y/y last month against a peak of 9.7% in June. This is a significant indirect sign that inflation is not spreading as dangerously through the economy as feared.

The slowdown in US inflation caused an impressive boost to risk-sensitive assets as it reassured markets that the Fed would slow the rate hikes in a 50-point move instead of 75 in December.

The Nasdaq100 index was above 12,000, gaining over 2.5% since the start of the day; EURUSD was a step up from 1.0450. Nevertheless, don't expect a repeat of last week's rally after the CPI release: much of it is already priced in. In addition, the markets are close to sensitive trend levels. The EURUSD and the Dollar Index are testing the 200 SMAs, which are essential trend lines.

Crossing at high rates often proves to be a strong signal of a long-term trend change. The S&P500 tries to get a foothold above the significant round level of 4000 and trades around its 200 SMA. Since the second half of April, its approach has intensified the sell-off in the index, taking 10% off in seven sessions at the end of April and in ten sessions in August.

Short-term traders should be prepared that such significant levels in these global market benchmarks will prove to be a tough nut to crack, and the buoyant growth of the markets will be put on hold for a while.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)