Dollar Strong on Resilient Job Data

- The dollar gained sharply on strong U.S. job data.

- Wall Street remains under pressure on potential Hawkish Fed ahead.

- Gold Climbs on heightened geopolitical tension and Trump’s uncertainty.

Market Summary

The U.S. dollar extended its rally, with the Dollar Index (DXY) surging to 109.00 for the first time since November 2022 following upbeat economic data. While U.S. PMI readings remained below the 50 threshold, they exceeded market expectations. Meanwhile, Initial Jobless Claims fell to 211,000—the lowest since May 2024—signaling a resilient labor market and fueling expectations of a more hawkish Federal Reserve.

Hawkish Fed sentiment continued to pressure Wall Street, as all three major indices closed lower in the previous session.

In commodities, gold defied the stronger dollar, climbing 1.3% as heightened geopolitical tensions supported safe-haven demand. Russia’s drone strikes on Kyiv and Israeli military actions in Gaza have intensified geopolitical risks, further boosting gold prices. Oil also advanced to a three-month high, buoyed by optimism over China’s economic outlook after President Xi Jinping pledged to prioritize growth in 2025.

Markets are now shifting focus to Donald Trump’s upcoming inauguration, with expectations of policy uncertainties adding another layer of volatility to the outlook.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.4%) VS -25 bps (9.6%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index extended its gains, buoyed by stronger-than-expected U.S. economic data and optimism over relative U.S. growth prospects. Initial Jobless Claims came in at 211K, better than the forecasted 222K, while the Manufacturing PMI registered at 49.4, surpassing expectations of 48.3. These positive indicators reinforced market confidence in a more hawkish Federal Reserve stance, further supporting the dollar.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 71, suggesting the index might enter overbought territory.

Resistance level: 109.50, 110.60

Support level: 108.60, 107.60

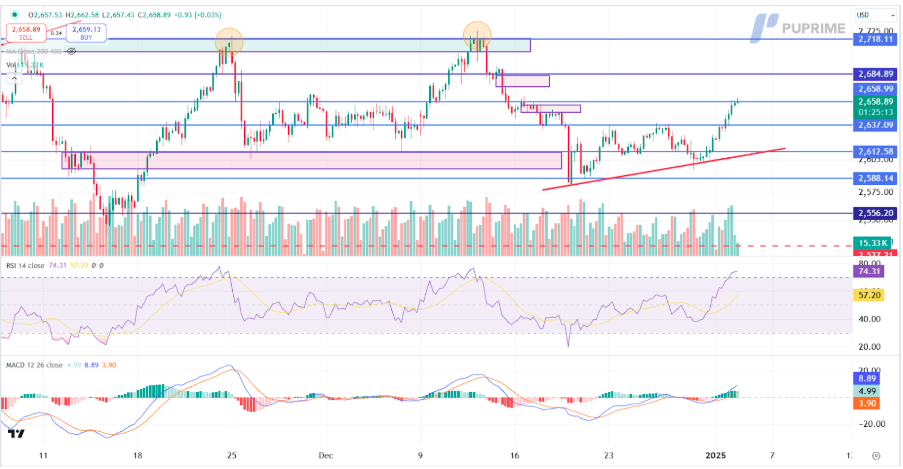

XAU/USD, H4

Gold prices also gained ground, driven by rising geopolitical uncertainties following a suspected terrorist attack in the U.S. Heightened security concerns have amplified safe-haven demand for gold, while expectations of slower U.S. GDP growth in 2025 and lingering uncertainty over President-elect Trump’s policies added to the metal’s appeal. Investors remain focused on these developments to assess potential shifts in market dynamics.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 74, suggesting the commodity might enter overbought territory.

Resistance level: 2660.00, 2685.00

Support level: 2635.00, 2615.00

GBP/USD,H4

The GBP/USD pair tumbled nearly 1.5% in the last session, hitting its lowest level since April and signalling a bearish outlook. The decline was driven by disappointing UK PMI data, which underscored weak economic performance and reinforced expectations of a more dovish Bank of England. Meanwhile, the U.S. dollar surged on stronger-than-expected job data, adding further downside pressure to the pair.

The pair has broken the previous support level at the 1.2505 mark, suggesting a solid bearish signal. The RSI has dropped into the oversold zone, while the MACD edged lower before breaking above the zero line, suggesting that the pair is trading with strong bearish momentum.

Resistance level: 1.2505, 1.2620

Support level: 1.2310, 1.2220

EUR/USD,H4

The EUR/USD pair dropped to a fresh low in the last session, weighed down by a stronger U.S. dollar. Persistent pressure on the euro stems from expectations of a dovish European Central Bank, while upbeat U.S. economic data has bolstered the case for a more hawkish Federal Reserve, amplifying downside pressure on the pair.

The pair slid by more than 0.8% to its 2-year low, suggesting a bearish bias. The RSI has entered the oversold zone, while the MACD is edging lower and diverging, suggesting that the bearish momentum is gaining.

Resistance level: 1.0330, 1.450

Support level: 1.0230, 1.0112

NASDAQ, H4:

U.S. equities, however, erased early gains on Thursday, weighed down by recent security concerns and a downward revision in growth expectations. The Atlanta Fed’s GDPNow model lowered its Q4 2024 growth estimate from 3.1% to 2.6%, dampening investor sentiment. Tesla’s stock fell over 6% after reporting record Q4 vehicle deliveries that nonetheless missed consensus expectations, contributing to the broader market decline.

Nasdaq is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 21150.00, 21820.00

Support level: 20395.00, 19860.00

GBP/JPY

The GBP/JPY pair fell nearly 1% in the last session, breaking below its previous liquidity zone and signaling a bearish outlook. The Pound Sterling remained under pressure amid a lack of catalysts, while the strengthening Japanese Yen, supported by upbeat inflation data and growing optimism for a January rate hike, continued to drive the pair lower.

The pair is trading in a lower-high price pattern, suggesting a bearish bias. The RSI is close to the oversold zone, while the MACD has broken below the zero line and is diverging, suggesting that the bearish momentum is gaining.

Resistance level: 196.00, 197.60

Support level: 191.90, 189.95

CL OIL, H4

Crude oil prices edged higher, supported by declining U.S. inventories and optimism surrounding China’s economic recovery. U.S. crude stocks dropped by 1.178M barrels, though less than the expected 2.400M decrease. In addition, poositive sentiment was bolstered by President Xi Jinping’s pledge for proactive economic policies in 2025, despite slower-than-anticipated growth in China’s December factory activity.

Oil prices are trading higher while currently near the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 68, suggesting the commodity might enter overbought territory.

Resistance level: 73.55, 74.40

Support level: 72.35, 71.45