The crypto market gathers strength after the rebound

The crypto market gathers strength after the rebound

Market Picture

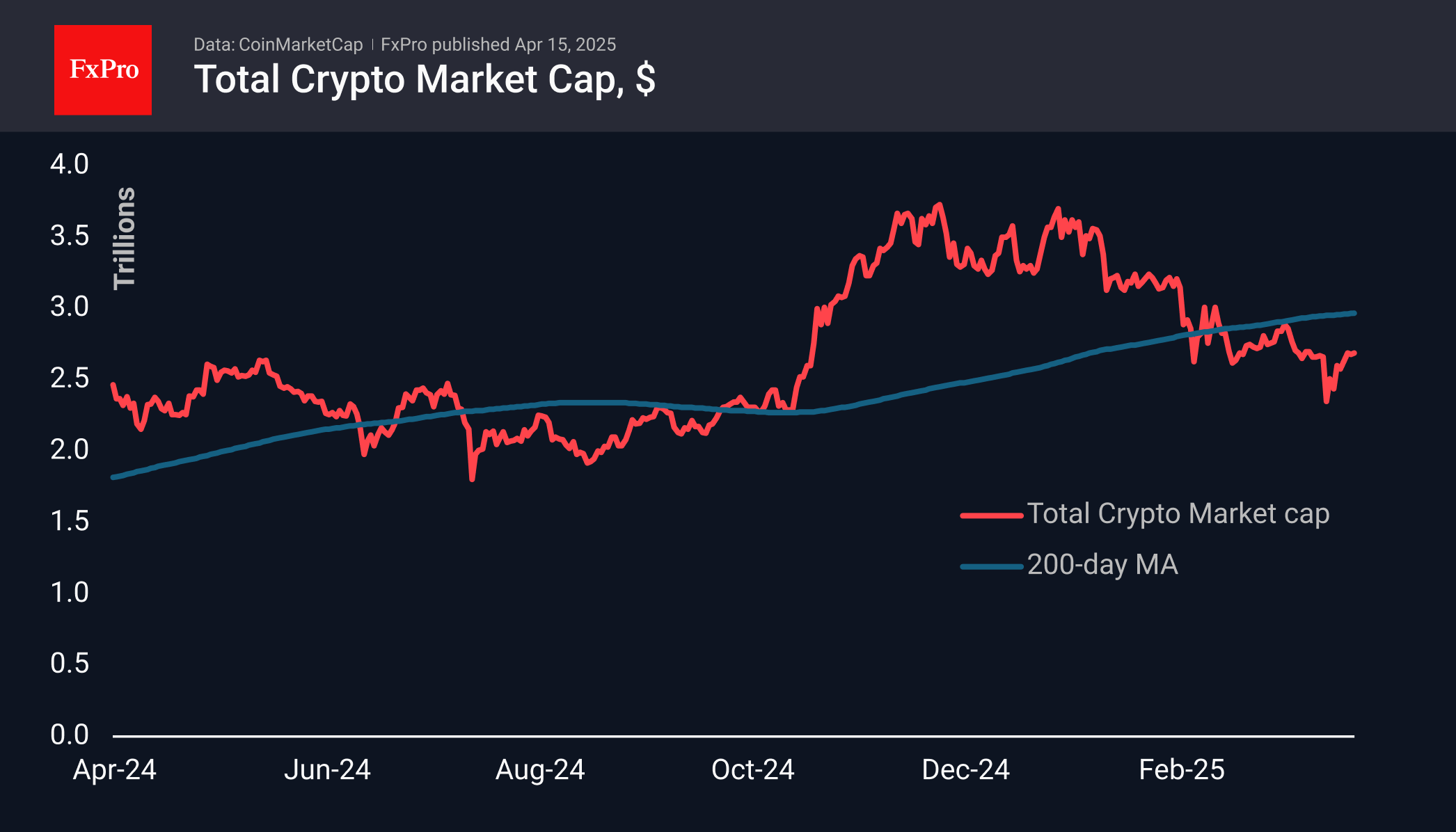

The cryptocurrency market added 8% over 7 days, stabilising at the $2.7 trillion level since Saturday. This is where the market tried to find support in the last days of March before collapsing at the start of April. A move higher could bolster hopes for further gains, but these expectations will only be confirmed after a solid consolidation above the 200-day moving average, which is now near $2.97 trillion.

Bitcoin continues its cautious rise, trading above its 50-day moving average and reaching $85.7K. This is an important technical attempt to reverse the downtrend. Interestingly, the 200-day average is quite close, so a second confirmation of a trend change could come quite quickly. However, from a pessimistic point of view, it is worth noting that bitcoin has entered a resistance accumulation zone where the strength of the initial rebound may fade.

Solana has added 20% over the past seven days. From a technical perspective, this is an attempt to get back into the bull market zone. Solana is recovering faster than many of the major altcoins, trading at its 50-day moving average near $130. A consolidation above this level will open the way to $145, the area of previous peaks. A sustained move above them will signal a break of the downtrend and could lead to a move towards $180.

News Background

According to CoinShares, global investments in crypto funds fell by $795 million last week after outflows of $240 million a week earlier. Bitcoin investments were down $751 million, Ethereum was down $38 million, and Solana was down $5 million, but investments in XRP were up $3.4 million, and Algorand and Avalanche were up $0.25 million.

Coinshares noted that recent tariff changes have led to record outflows of $7.2bn, effectively levelling out almost all of the inflows since the start of the year.

Call options on Bitcoin at $100K were the most popular on the Deribit platform, with a total open interest of nearly $1.2bn, according to CoinDesk analyst Omkar Godbole. The $70K put options were the second most popular, with $982 million in open interest.

Project Mantra's MANTRA token (OM) collapsed by 90%, and its market capitalisation dropped from $5.5 billion to $765 million. The crypto community suspects fraud, calling it the biggest rug pull since the collapse of LUNA and FTX.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)