Crypto stabilises at cosy height

Crypto stabilises at cosy height

Market Picture

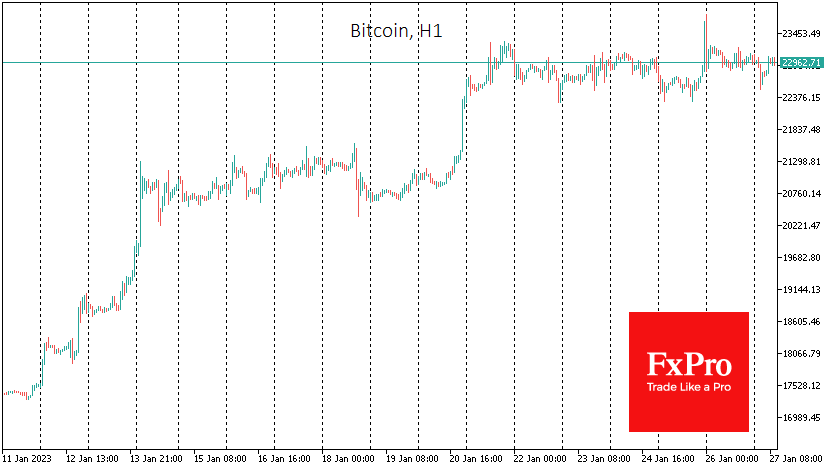

Bitcoin is currently trading at around $23.0K. Spikes to $23.7K and down to $22.5K leave their mark on the chart but do not move the market's balance point. Interestingly, this oscillation occurs with a rising equity market in the background and a moderately weaker dollar, although this environment often feeds demand for risk.

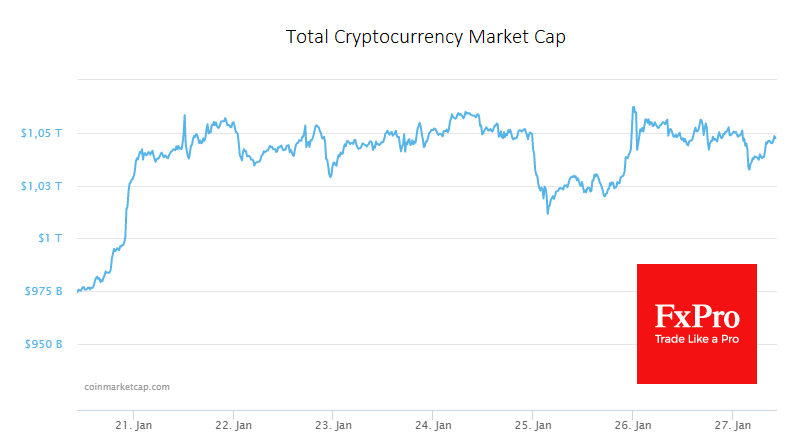

This buyer passivity may be a consequence of fatigue after the 44% rally since the start of the year, but it may also reflect an internal pull to sell on the upside. This applies to the crypto market, whose capitalisation has stabilised at just over $1 trillion.

It is worth being prepared that there may be a lack of major moves until the Fed's decision next Wednesday.

News Background

According to research from CryptoCompare, the market share of algorithmic stablecoins has dropped sevenfold since April last year to 1.7% of all stablecoins.

US Senator Elizabeth Warren has said that the crypto industry fears a crackdown by the US Securities and Exchange Commission (SEC). However, she said the SEC should redouble its efforts to provide maximum protection for investors.

Gabriel Makhlouf, Governor of the Central Bank of Ireland, has proposed a ban on cryptocurrency advertising to protect retail investors from losing money.

China's tax authorities have increased pressure on retail crypto investors, requiring exchanges and retail and corporate investors to provide comprehensive information on all digital asset transactions from the beginning of 2022.

Amid a general market rally, the price of the Aptos (APT) cryptocurrency has risen more than 390% in the last 30 days. Aptos has surpassed Stellar and Bitcoin Cash in capitalisation (almost $3 billion) and is approaching Ethereum Classic and Monero. The leading BNB chain-based decentralised exchange, PancakeSwap (PCS), announced its integration with Aptos in October.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)