Yen enters a new downfall

Yen enters a new downfall

Consumer prices in Japan continue to rise steadily, but this is of little concern to the central bank – a brutal combination for the Yen, which could repeat last year's alarming decline.

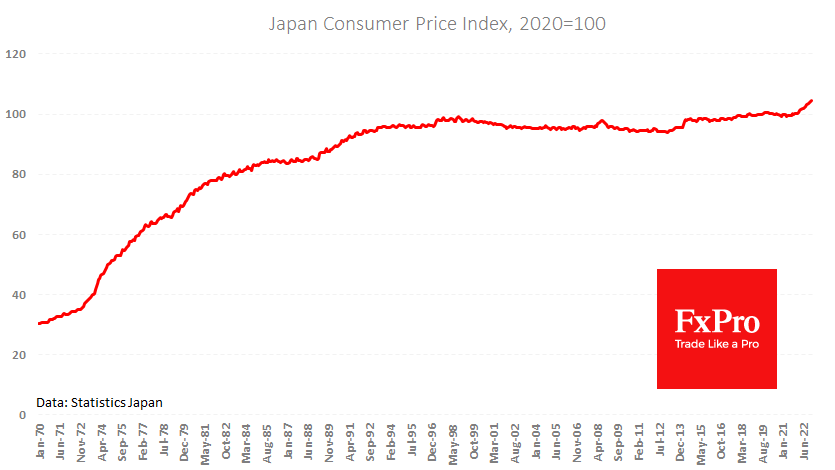

Japan's CPI rose 0.5% in January, the 15th month without a decline. The annual rate of increase also continues to grow, taking headline inflation to 4.3% and, excluding food and energy, to 3.2% y/y. This is the highest rate of price increases since the early 1980s.

From a technical point of view, the nominal CPI has broken through the resistance of the peaks at the end of 1998 and continues to rise steadily. Nevertheless, there are concerns that the monetary and fiscal authorities still need to change their policy stance.

The primary candidate for the BoJ chairmanship confirmed in his speech today that low-interest rates are now acceptable, as inflation is being driven by rising import prices rather than demand.

These comments have the potential to finally undermine hopes that the Bank of Japan has followed much of the rest of the world in turning its back on inflation. Expectations of such a turnaround have recently worked in favour of a stronger Yen. Before, in October and November, demand for the Yen was driven by verbal and actual interventions in defence of the national currency.

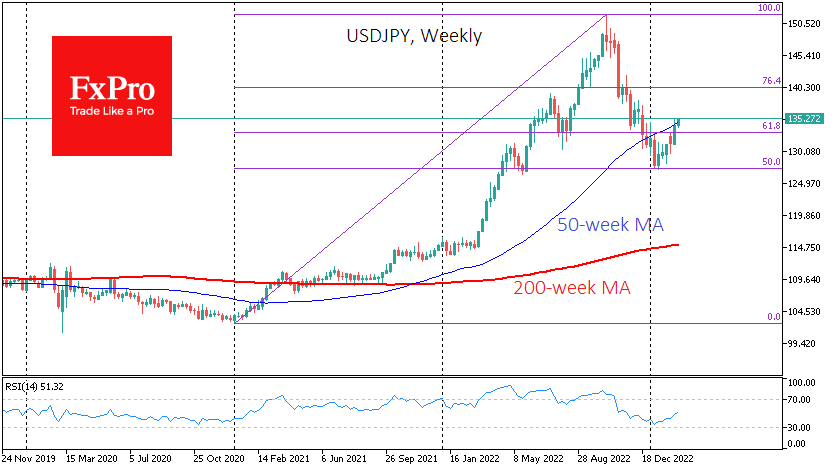

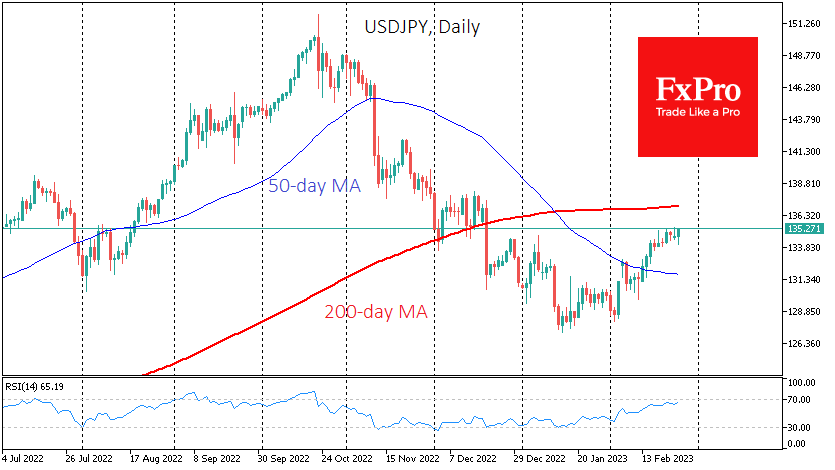

The USDJPY is down more than 15% from its October high of 152 and has found support on the downside at 127, where a local reversal area from last May's upward correction and a 50% retracement of the rally from the 2021 lows at 102.6 coincide.

Comments from the country's monetary authorities suggest a new wave of pressure on the yen after three months of easing or ‘recharging’. With the Bank of Japan not changing policy, the yen is potentially under pressure from an intensified interest rate differential game. And this game promises to be more aggressive now than a year ago, as yield spreads between Japan and the US have widened for both short and long-term yields.

Without a reversal by the BoJ, the USDJPY could be back around 150 by June. The yen would then be 15% lower than a year ago, which aligns with the standard depreciation rate for developed market currencies. Our observation is that officials only move from words to deeds when the exchange rate deviates by more than 20% YoY.

The current higher interest rate environment is an opportunity for Japan to competitively devalue its currency to support national exporters, which it failed to do in the last decade in the era of zero interest rates.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)