Lending in Britain slows, weighing on the pound

Lending in Britain slows, weighing on the pound

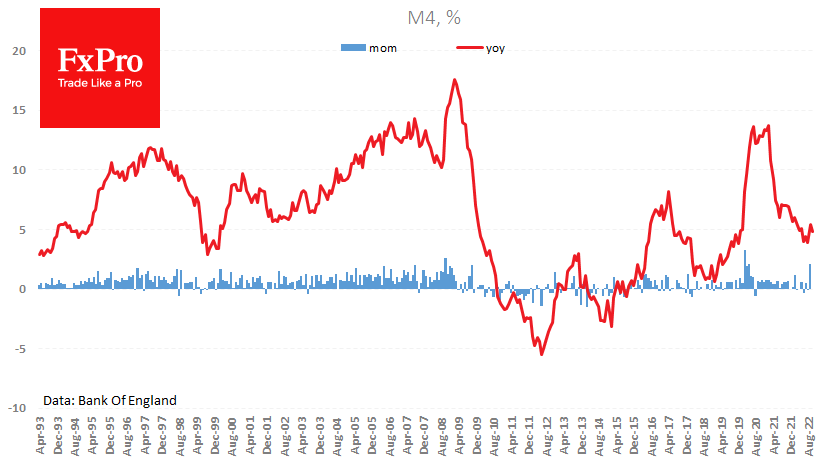

The UK's money supply and credit data showed a much stronger-than-expected slowdown - an important signal of a slowing economy. Broad money supply (M4) was unchanged in October and added 4.8% y/y, significantly below inflation at 11.1% y/y. The money supply growth rate has been falling since last February following the covid stimulus boom. But in recent months, a downward trend in lending considering rising interest rates has also become prominent.

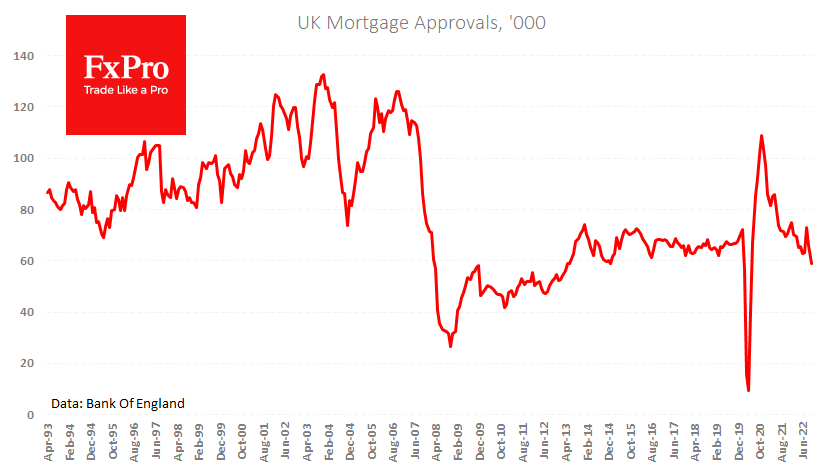

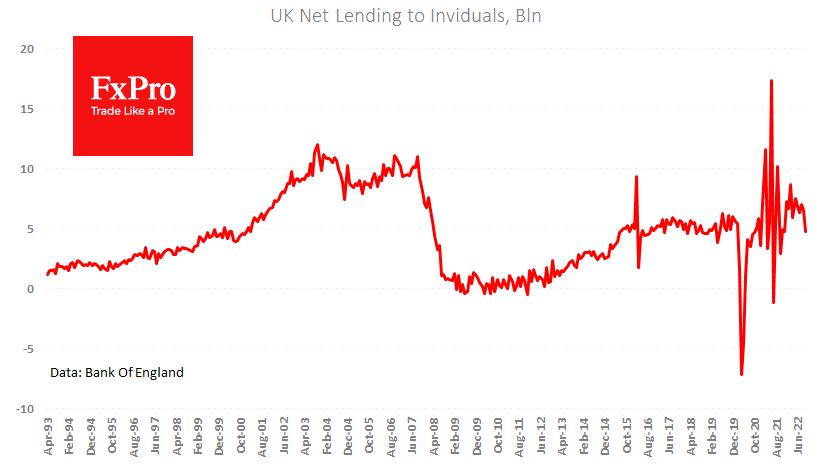

The number of approved mortgage applications in October was 15% lower than a year earlier. Excluding the collapse in the early months of the coronavirus, these are the lowest levels in nine years. The net increase in personal loans for October was 4.74bn, compared with a monthly average of 7bn since the start of the year. The fading here is like what we saw in the mortgage lending crisis. However, the difference is that between 2007 and 2009, the Central Bank fought the credit crunch by bringing the rate down to the floor and launching QE, while now the slowdown in the circulation of money is the policy objective.

In the UK, the decline in mortgage lending is explained by the fact that loans are mainly made at floating rates, and warnings from the Bank of England about further policy tightening may deter home purchases, especially given the prospect of rising daily and utility costs. This explains the more rapid transmission of monetary policy against the US, where mortgages are mainly issued at a fixed rate. This provoked a surge in new lending in the early stages of its rise, only to cause a downturn months later.

For the pound, the fall in money supply growth and the downturn in lending is relatively bearish news as it raises the question of whether the Bank of England can significantly narrow the rate gap with the US. Since 1985 the Bank of England’s key rate has almost always been higher than the US rate. This difference was significant in 2002-2007, supporting the rise in GBPUSD. The latest data suggests that this will not recover in the foreseeable future, making it difficult for the pair to rise near 1.2200 without help from fundamentals.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)